PROCEDURE FOR IMPLEMENTING FINANCING SECURITY

Context

In an economic environment that is increasingly gloomy and plagued by the questionable morality of certain economic operators on the one hand and on the other hand the difficulty for financial institutions to recover their financing; Third Party Detention appears today as a complementary guarantee for financing and as such it plays two roles:

Not only is third-party ownership a guarantee based on the financed stocks and of which full possession is held by the bank.

In addition, third-party custody secures the financing of financial institutions through very effective operational and legal mechanisms.

Foregoing

Before entering into the prerequisites of third-party detention, it is important to define this concept which is a financing mechanism that allows goods to be pledged for their market value. This mechanism involves three (03) actors who are:

- Le financial (Bank)

The third party holder

The client (the borrower)

In other words, the Borrower who requests a loan from a Bank, a loan for which he does not have sufficient collateral to cover his loan; is therefore offered Third Party Detention to pledge the goods subject to financing. These goods will be under the supervision of an agent who represents the Bank in the place where the goods are stored.

For effective third party detention, it must be done in the following manner:

- In the customer’s store;

- The store must not be shared by any other person other than the customer himself and the third party holder who will carry out the opening and closing together;

- The customer must give the third party holder free access during the agreed hours to the storage store;

- The Customer must present comprehensive insurance for the store as well as his lease agreement if he is a tenant or a receipt for the property tax if he is the owner.

Once these prerequisites are met, we can now move on to the implementation of the third-party detention itself. The implementation of the process of securing financing for banking institutions begins with the development of a framework agreement between INTERKAUFEN and a banking institution or any other financier. This agreement establishes the basis for good collaboration and defines the obligations and rights of each party. This agreement includes all the activities to be carried out by INTERKAUFEN on behalf of the financial institution, namely:

- Study of the file (jointly with the financial institution) on the operational level with submission of a report. This study assumes the knowledge of the client, a visit to the client’s site to carry out a site inspection as well as an objective opinion on the level of risk presented by the client’s activity. And finally the collection of the client’s tax and administrative information.

- Provide additional security through the “Stock Pledge”;

- Monitor import and export cargo via the Single Window platform to determine the position of the financed goods at any time

After this stage of the framework agreement, when a financial institution entrusts us with a file, we draw up in due form a tripartite agreement protocol that binds the client (debtor), the financier (creditor) and the third party holder in which we define the rights and obligations of each of the parties. This protocol will be established in two stages:

- The first step which concerns the study of the file which can result in a refusal of financing or its validation. This study of the file supposes a descent on the site to learn about the real activity of the client as well as his expressed financial need. The fees paid by the client for this activity independently of the final decision of the bank whose withdrawal will be made automatically by the bank for the benefit of the third party holder, are included in the file opening fees at INTERKAUFEN.

- These fees do not take into account the travel of the third party holder if the activity must be carried out outside the city of Douala and all the other due diligences that are made.

- The second stage of the memorandum of understanding is validated once the bank has notified the customer of the credit agreement. Depending on the customer’s needs and on the basis of the study carried out above by the third party holder, a working method is defined as well as the price of the third party holder’s service. This price is a percentage of the overall financing, between 0.5 – 1% and a monthly lump sum (1,000,000 – 2,000,000 FCFA) over the duration of the credit repayment. It is important to note that the payment of the third party holder’s services is the responsibility of the customer. The bank must therefore collect said sums from the customer’s account for the benefit of the third party holder. This method makes it possible to avoid a relationship of subordination between the customer and the third party holder and therefore preserve its independence.

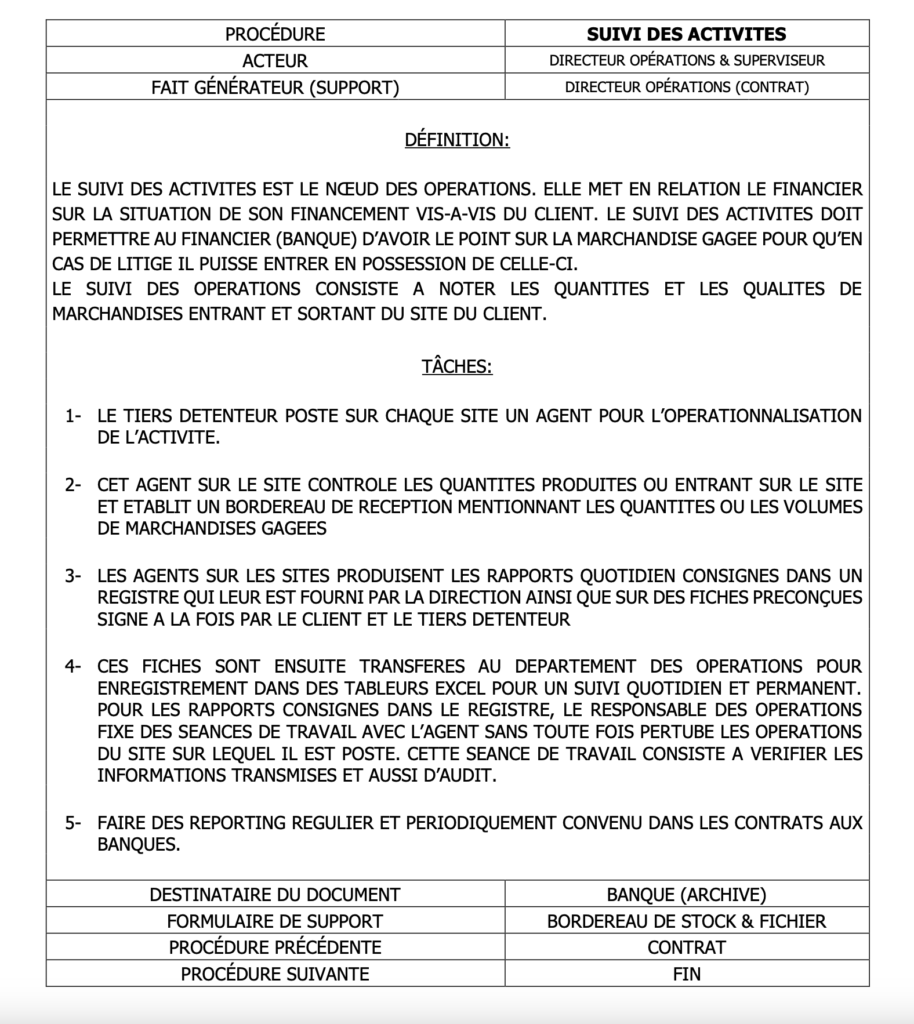

After signing the tripartite agreement, INTER-KAUFEN meticulously implements the working method that has been jointly validated by the various parties. INTER-KAUFEN keeps a daily report of all its operations in terms of stock movements and/or fund collection. If the bank so wishes, a report of these operations is established according to the frequency it has decided. Below is a clear and concise diagram of the procedure for setting up third-party custody.

SUCCESSIVE STAGE OF THIRD-PARTY DETENTION

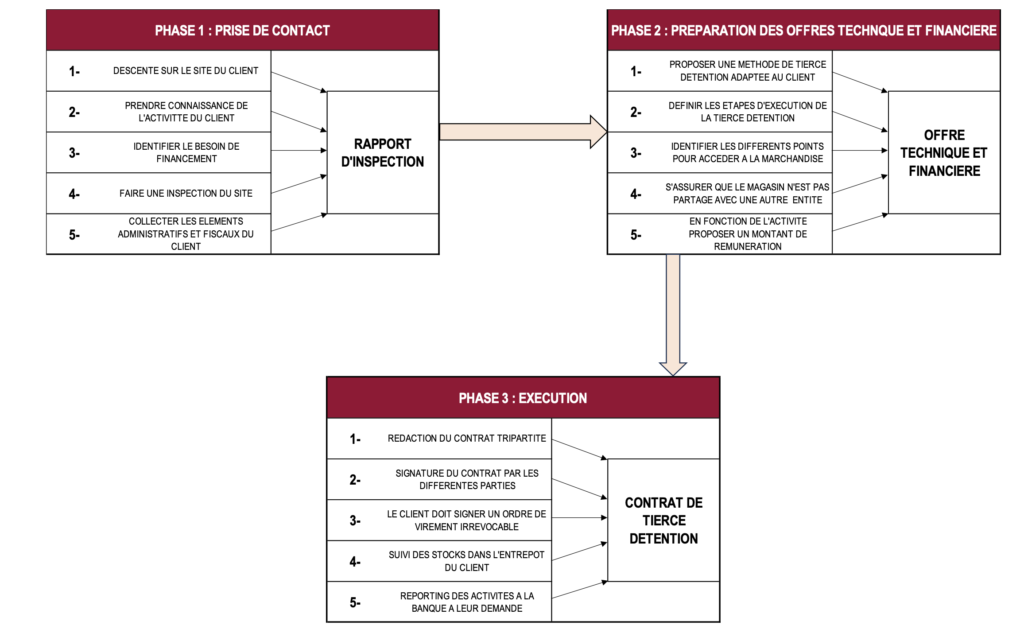

Procedure KYCC

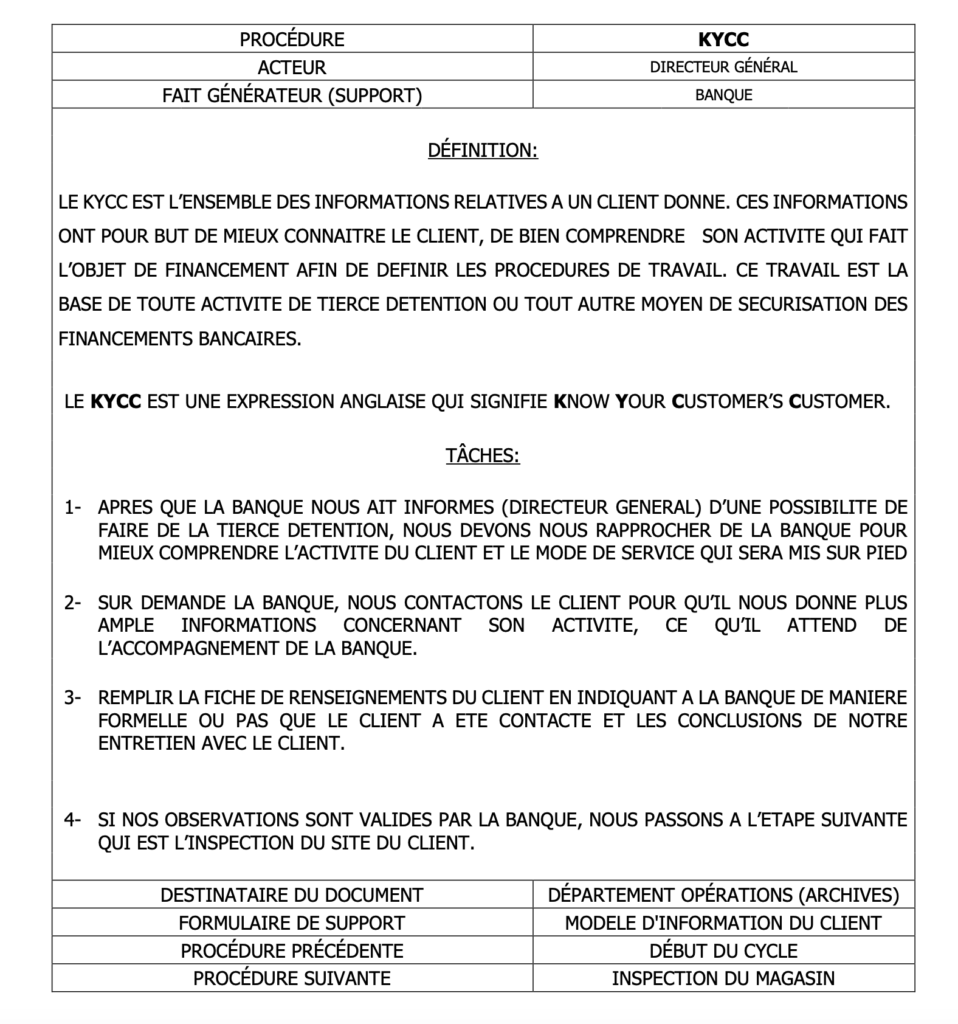

Inspection du site

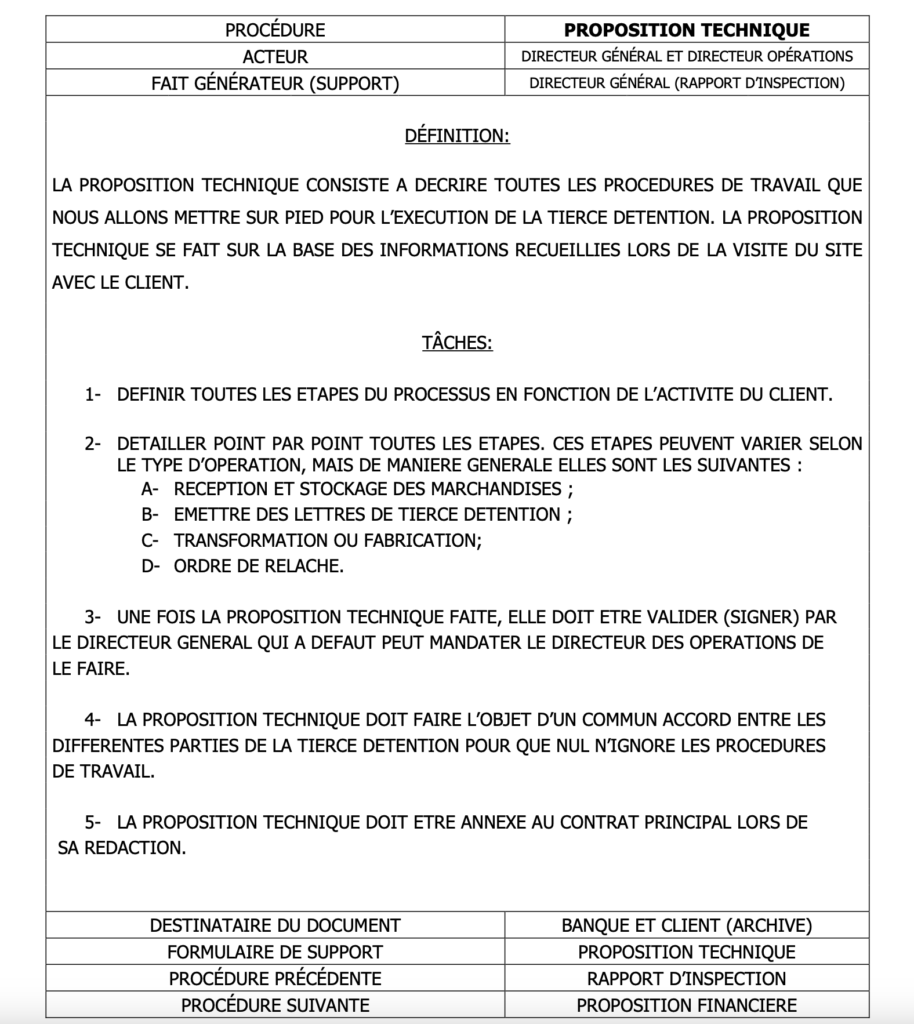

Proposition technique

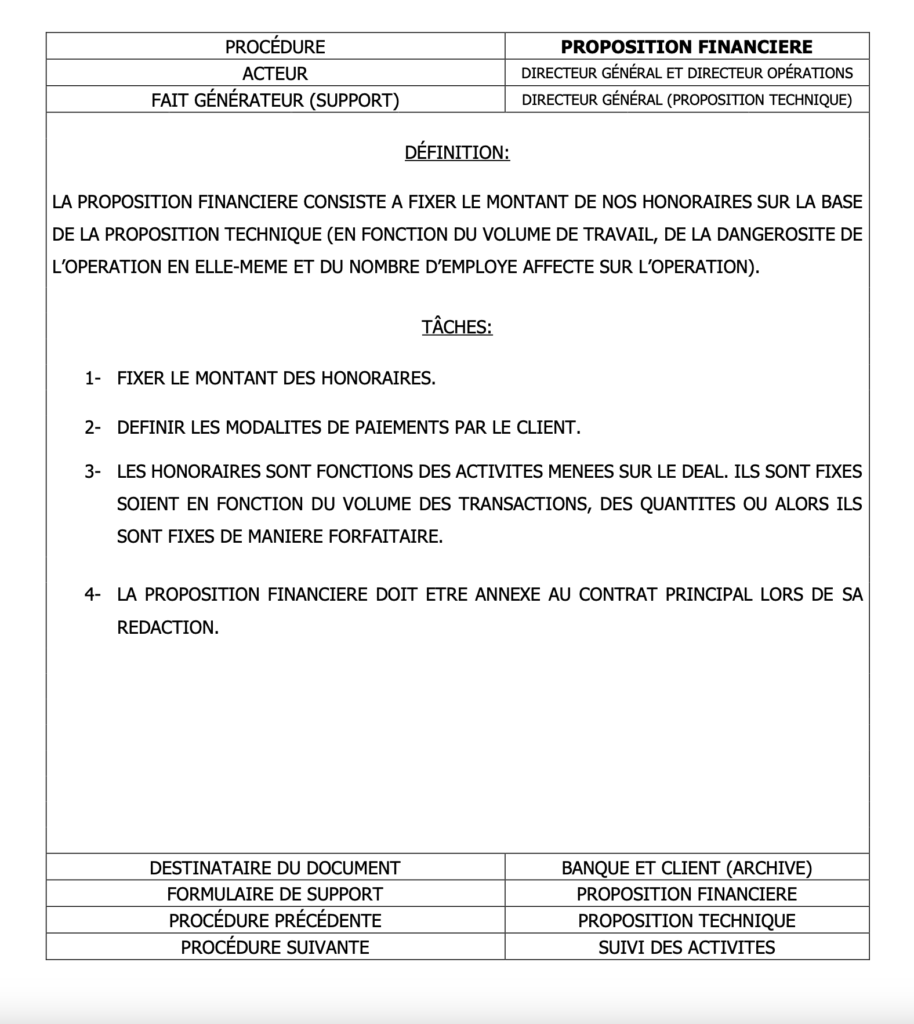

Proposition financiere

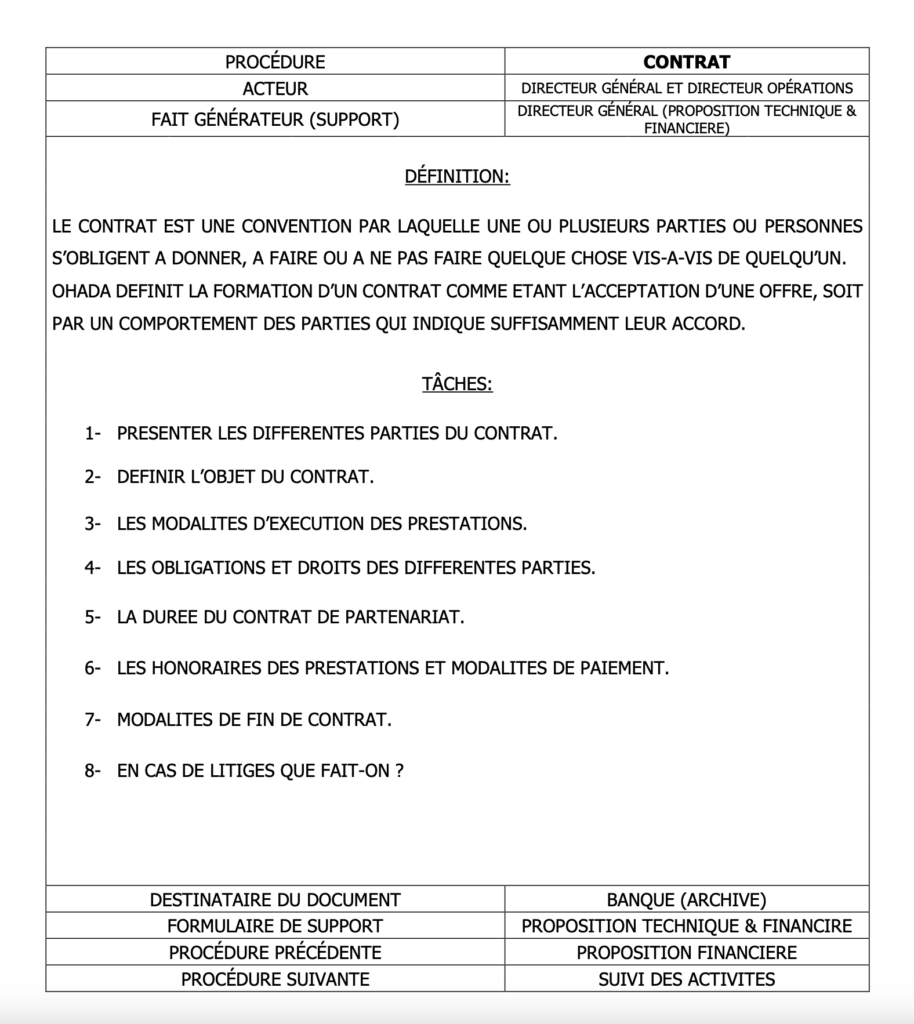

Contrat

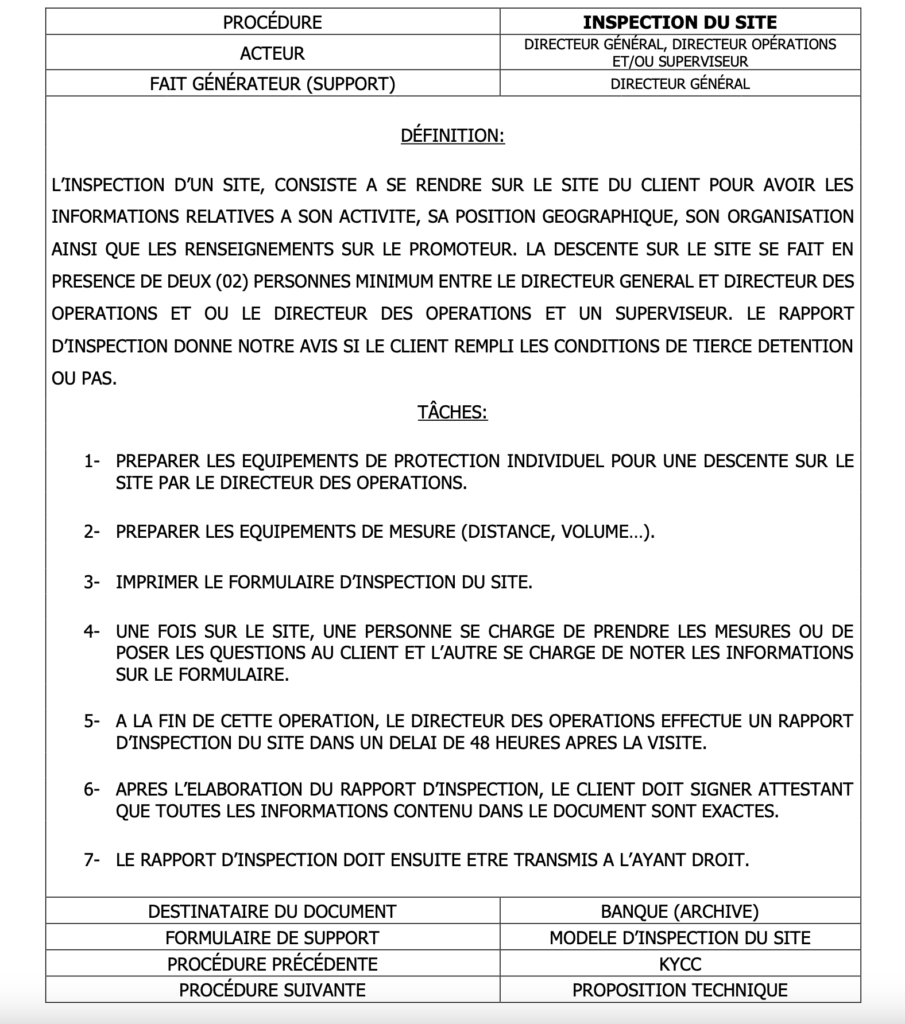

Suivi des activités